Interest in obtaining ratings for subscription-secured credit facilities continues to grow as banks face capital constraints, increased regulatory scrutiny and internal exposure limits and insurance companies look to deploy capital as lenders to investment funds. S&P Global (“S&P”), a leading ratings agency, has published its “Methodology For Rating Subscription Lines Secured By Capital Commitments”, in which S&P sets out how it evaluates a subscription-secured credit facility for ratings purposes.

While there is sure to be continued analysis and discussion in the market in the near term as to the desirability of ratings and the methodology, our first impression is that the framework is broadly consistent with how lenders have approached risk-assessment, structuring and documenting subscription-secured credit facilities, taking into account the fundamentals that have provided the foundation for these facilities for over three decades.

S&P sets out the key terms of its analytic framework as follows:

For subscription line facilities, we:

- Evaluate the creditworthiness by considering the likelihood that LPs' capital commitments can be relied upon to repay facility draws.

- Use CDO Evaluator to assess the capacity of funding available from LPs through their capital commitments. This measures the ability of this repayment source.

- Assess willingness/structure because LPs may choose not to perform despite being able. And even if they do perform, the flow of payments could be compromised.

The S&P methodology will apply to any subscription-secured facility in which the lender has: (1) a first-priority perfected lien on the LP capital commitments of a closed-ended fund, (2) “direct access” to capital contributions, whether prior to or after a “missed payment”, and (3) a pledged collateral account where capital contributions are captured. S&P also specifically notes that “[w]e expect the primary source of repayment to be from calls on the LPs’ undrawn capital commitments.” While this condition seems redundant given the nature of subscription-secured facilities, it is perhaps meant to eliminate hybrid facilities. Given that subscription-secured facilities are structured to ensure that undrawn capital is available as the source of repayment, this prong is easily met.

In the absence of these conditions, S&P will use its Alternative Investment Funds methodology (“AIF methodology”).

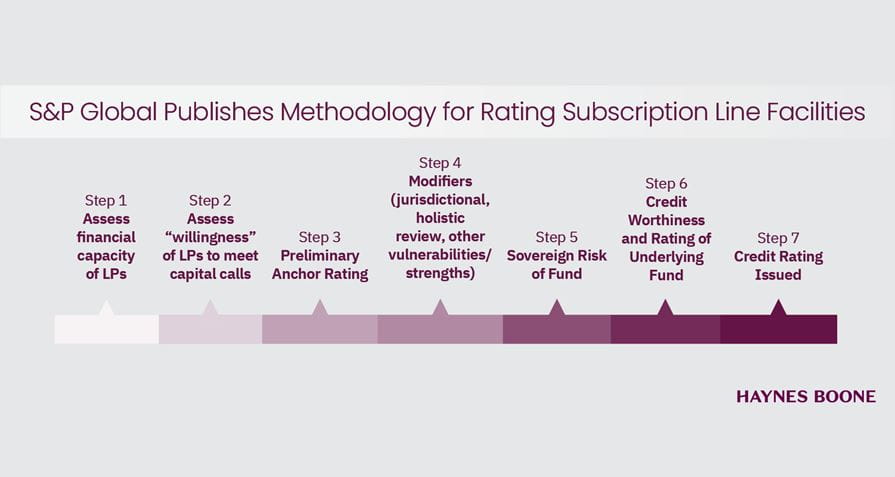

The framework sets out the assessment in chronological steps. Each step correlates with the parallel process by which lenders and their counsel diligence a subscription-secured facility.

Step 1: Assessment of capacity of LPs

S&P assesses the credit of the individual LPs in order to complete a larger group analysis using a Monte Carlo simulation model. This is similar to the process lenders use to determine a borrowing base, which subsequently drives loan availability, pricing and other terms for a particular subscription-secured facility.

Step 2: Assessment of “willingness” of LPs to meet capital calls

This prong combines the intangible factors that lenders and their counsel frequently discuss to determine designation of a particular LP in the borrowing base, with consideration of the legal obligation of LPs to contribute capital for repayment of a facility.

This is consistent with a lender’s analysis where every subscription-secured facility begins with diligence on the limited partnership agreement (“LPA”) of the fund. How clear are the legal obligations of the LPs to make contributions to repay a facility? Does the LPA include all of the “bankable provisions” regarding the credit facility for the benefit of the lender that contribute to a strong subscription-secured facility structure?

Consideration is also given to whether the LPs are motivated to contribute even if the fund underperforms. What penalties does an LP incur if it fails to contribute capital when called? Does the GP have customary remedies available if an LP defaults?

The S&P methodology also takes into account invested capital ratios, GP quality and historic sponsor performance, including performance relative to peers, absence of debt at the fund level, clean audit reports and jurisdictional risk. This analysis aligns with lenders’ evaluation of a fund sponsor and in negotiated credit facility provisions, such as prohibitions on fund-level debt.

Step 3: Anchor rating

S&P determines a preliminary rating, which it will test and adjust in the following steps.

Step 4: Modifiers

Fund jurisdictional risk, risks related to LP FX risk and operational risks may modify the proposed rating, and S&P asserts that it looks at all of the factors holistically, as well as with particularity, to determine the final rating.

Again, these factors correspond to a lender’s approval process for a subscription-secured credit facility, and may come to light during the typical diligence on fund documents and potential borrowing base investors.

Step 5: Sovereign risk

If the “preliminary issue rating is higher than the rating on the sovereign where the fund is domiciled,” sovereign risk is assessed.

Although the framework does not go into detail on sovereign risk, lenders tend to lend into jurisdictions they and the market are familiar and comfortable with. Sovereign risk is usually more of a concern as it relates to a particular LP and the issues of sovereign immunity or factors of enforcement in a “foreign” jurisdiction.

Step 6: Creditworthiness / AIF Issue Rating

This step of the methodology focuses on the fund’s creditworthiness; explaining that if it is stronger than the credit assessment determined above, S&P will likely apply its AIF methodology instead. This step states that, absent sufficient information to assess the fund’s creditworthiness, S&P would not regard the fund as the “likely source of repayment.” Given the recourse nature of subscription-secured facilities, we find this description somewhat confusing. If the four key parameters exist that trigger use of this subscription-secured facility methodology, it is not clear why S&P would employ a different method that does not focus on the particular facility. As more facilities are rated we would expect to have a better understanding of Step 6.

Conclusion

It is worth reading the entire methodology, which provides detail for most of the steps, examples for some of the rating analysis and links to other relevant or related criteria. S&P clearly took into account information and comments from the fund finance industry in developing this methodology and the increased transparency will serve the industry if ratings become more common. It is encouraging to see that the framework reflects the reality of the market’s approach to analysis of subscription-secured facilities, and sets out a rational and comprehensive approach.

The S&P guidance follows similar methodologies published by Fitch and KBRA last year on rating subscription-secured facilities.