When a subscription line credit facility (a “Facility”) closes, the initial Facility size (the “Closing Date Availability”) is reflective of the fund’s current investor pool and the available commitments of the lender group. Many Facilities also have an accordion option to increase the size of the Facility from time to time up to a prescribed amount (the “Additional Availability”), as fundraising progresses and additional lenders develop interest – the administrative agent may obtain credit approval to increase its own lender commitment, or it may syndicate and bring in additional lenders (or both).

Two metrics jump out when surveying Facility sizes from 2022 and the first half of 2023:

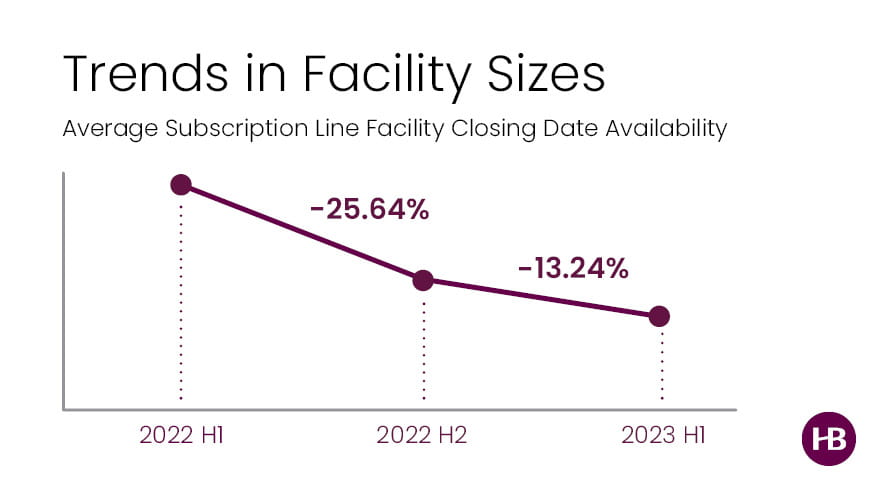

1) Average Closing Date Availability – Over the past 18 months, the average Closing Date Availability has decreased as shown in the graph above (see above image).

2) Average Additional Availability - Over the same period, the average Additional Availability across these same deals increased by just over 6%.

Decreases in Closing Date Availability have been driven by:

- Fundraising slowdown in the current market, both in amounts raised and the length of time it takes to close a fund, leading to funds generally having less aggregate investor commitments at initial closing than in prior funds;

- New lender entrants are testing the market, resulting in smaller initial commitments offered to borrowers; and

- Rising pricing rates and costs on Facilities, including increased unused and upfront fees, causing funds to be more cautious about Facility size, requesting only what is necessary for the short-term.

As the Closing Date Availability has decreased, the Additional Availability has increased. It appears that both funds and lenders remain optimistic about longer term fundraising, though Additional Availability increases are typically not committed. It may be that funds want to secure the allocation, even subject to successful syndication, while maintaining larger fund targets and providing lenders time to ascertain the market before agreeing to an additional commitment.

These insights are based on data from hundreds of Facilities Haynes Boone worked on during this period for large domestic and international lenders and newer entrants and regional banks.

For more information on Fund Finance market trends, please reach out to any member of the Haynes Boone Fund Finance Practice Group.

For additional News and Insights, please subscribe to our email list.