“After a tumultuous 2023, pricing in 2024 has largely stabilized in the subscription line market,” say Shultz and Zhang.

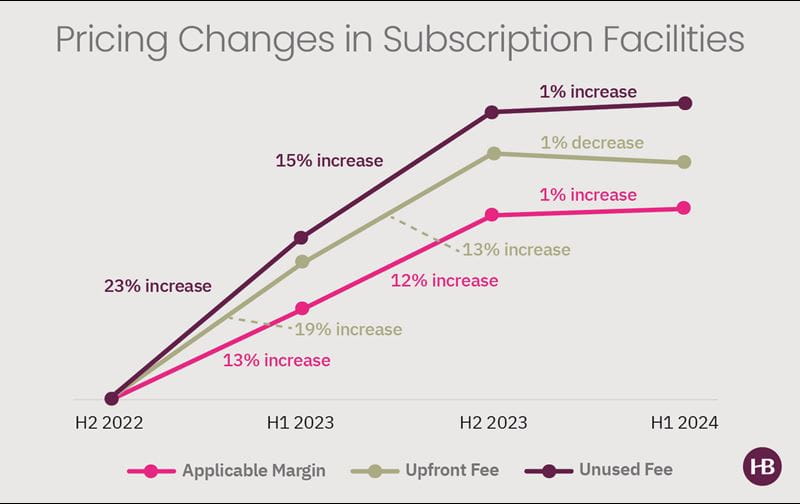

Against the backdrop of the regional banking crisis, rising interest rates, a challenging exit environment and difficult fundraising, pricing in subscription secured credit facilities (“Subscription Facilities”) saw double-digit percentage increases in applicable margins, upfront fees and unused fees throughout 2023. However, the first six months of 2024 have shown relatively stable pricing.

At a glance:

- Overall market pricing has stabilized, though we note that increased prices for smaller Subscription Facilities ($100mm or less) has been offset by stable or slightly decreased pricing for Subscription Facilities of more than $100mm.

- Applicable margins of Subscription Facilities increased by just 1% over the first half of 2024, compared to a 25% increase across all of 2023.

- Upfront fees decreased slightly by about 1% over the first half of 2024, compared to a 32% increase across all of 2023.

- Unused fees remained almost flat, with a slight increase of 1%, compared to a 38% increase in all of 2023; and bifurcated usage tiers for unused fees have become increasingly common.

While these insights are based on averages and don’t reflect the individual pricing strategies of any one lender or sponsor, they indicate that the market, as a whole, has largely stabilized after the turmoil of 2023.

The average pricing from the first six months of 2024 for applicable margins, unused fees, and upfront fees fell squarely within the majority response from our 2023 Fund Finance Survey and Report, in which participants did not expect significant pricing movements in 2024. Even with this higher pricing after the substantial increases these past two years, as compared to the prior decade, 81% of private equity funds and 71% of venture capital funds noted they are utilizing their Subscription Facilities the same as in prior years.1

Applicable Margins

Applicable margins remained relatively stable in the first half of 2024, increasing by ~3% for smaller facilities and decreasing by ~2% for larger facilities, for an average increase of ~1% market-wide in the first half of 2024. This compares to a 13% increase market-wide from the second half of 2022 to the first half of 2023 and a 12% increase between the first half of 2023 and the second half of 2023. While it is common to see higher applicable margin pricing for smaller facilities, this is sometimes offset by lower average upfront and unused fees.

Upfront Fees

The first half of 2024 saw a slight moderation for upfront fees, with average fees decreasing by ~1% market-wide, with larger facilities decreasing by ~3% and smaller facilities increasing by ~1%. This is in contrast to the 19% increase from the second half of 2022 to the first half of 2023 across the market and a 13% increase between the first half of 2023 and the second half of 2023.

Unused Fees

For the period measured, unused fees have increased at the greatest rate, with a 23% increase from the second half of 2022 to the first half of 2023 and a 15% increase between the first half of 2023 and the second half of 2023. However, the trend for unused fees remained almost flat in the first half of 2024, with a slight increase of only ~1% across the market as a whole. While larger facilities decreased by almost 4%, smaller facilities increased by ~2.5%. Additionally, the bifurcation of unused fees has become a common tool for lenders to incentivize borrowers to utilize facilities. More lenders adopted bifurcated or even multiple usage tier structures for unused fees. The range of bifurcated unused fees also increased over the past year, with a difference as high as 25-40 bps between the bifurcated utilization rates for some deals in the first half of 2024, compared to 5-10 bps typically seen in a bifurcated structure for unused fees in the past.

These insights are based on data from Subscription Facilities, primarily U.S.-based, documented by Haynes Boone during the referenced period for the largest domestic and international lenders, as well as for regional and super-regional banks.

For more information on Fund Finance market trends, please reach out to any member of the Haynes Boone Fund Finance Practice Group.

For additional News and Insights, please subscribe to our email list.

1 Silicon Valley Bank, Trends Impacting Private Equity and Venture Capital: Global Fund Banking Outlook Report H1 2024, https://www.svb.com/globalassets/library/uploadedfiles/h1-2024-outlook-report.pdf